No, it wasn’t because of the balance.

I was able to click on a check I had written and see a copy of that check.

Instantaneously.

That made me realize how much banking has changed since I had my first job in a bank.

During my senior year in high school, I took a class in “Office Education” which, aside from drinking beer before every half-time marching show, turned out to be the most productive activity during my high school career.

The best part about Office Education was that I actually got to work in the local bank (First National Bank) for half the school day.

The best part about working for half the school day was that I never had to take trigonometry.

Anyway, I worked in the checking account department in the little bitty bank in my little bitty home town. Mind you, this was 1977 and, although many banking operations were computerized back then, there was not one iota of computerized anything in the bank where I worked.

Everything was all done manually.

Actually, we took sticks and rocks in and out of the vault to indicate how much money each person had in their account.

Well, practically.

Each day, one woman would take all the checks and deposits from the tellers and use a big, clunky machine to verify that they were equal.

Then, several of us would put all the checks in alphabetical order by hand. This was back in the day when many of the checks were “counter checks” - - just blank checks that everyone in town used - - no names printed on them, no account numbers.

Then, I would take all the checks to another big, clunky machine and begin “posting” them to everyone’s account. Always, with a can of Tab diet soda by my side. (To this day, I love Tab and it reminds me of working at the bank in high school).

I would take your actual bank statement (we had just switched from using papyrus) carry the balance forward, subtract the checks, add the deposits, and the machine would type in a new balance - - - automatically!

If an account didn’t have enough money, we'd hit it with a whopping overdraft fee of - - are you ready for this? - - -two dollars and fifty cents.

There was no such thing as a “bounced check.” We would just carry your balance in the negative and eventually, Mr. Dohmann from the bank would call you on the phone.

Since many of the checks weren’t personalized or had account numbers on them, we’d often have to use intuition to figure out which account to take it from.

For example, if Mr. Henderson wrote a check to the feed store, we would just know to debit his “farm account” rather than his joint account with his wife.

At the end of the day, all the checks and deposits that I posted had to balance with the lady’s totals from the first big, clunky machine.

My totals never balanced.

So, I had to go through all of my postings and find out where I made a mistake. I learned a lot about how to find errors.

For example, if my “outage” was divisible by nine, that meant that I had transposed a number somewhere.

Really. Take the number 4167. Transpose it to 7614. The difference is 3447 which can be divided equally by nine - - - 383.

A more simple one. 69 transposed to 96. The difference is 27 which, divided by 9 is 3.

See? That's a lot more useful to know than trigonometry.

After all the checks were posted, I’d file them in each account-holder’s little file which contained the signature card. As we put each check in the file, we’d compare the signature on the check to the card. - - After all, anyone could write a check on any account simply by signing it.

However, we pretty much had everyone’s signature memorized.

For example, one time my cousin wrote himself a thirty-dollar check on my grandmother’s account (which I caught while filing the checks) and oh boy, did he get in trouble!

At the end of the month, we’d fold up everyone’s statement, plunk in the cancelled checks, stuff it in an envelope and mail it to them.

That is, unless they just wanted to pick up their statement at the bank (we automatically knew who wanted to) and we’d leave their statement with the teller.

So, you can see why I was pretty amazed when I could instantly look at my cancelled check online the other day.

Banking has certainly come a long way during my lifetime.

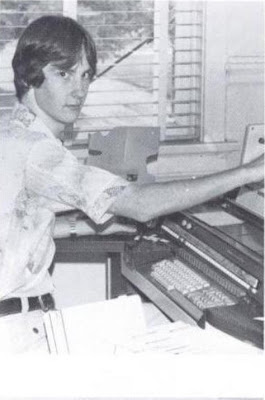

Oh, and here’s a photo from my senior yearbook. That's moi, posting checks at the bank on the big, clunky machine.

And look what's on my desk right now

Oh crap. I was all enthralled in your story and then you went and started talking about numbers. Dammit, man, I was an English major!

ReplyDeleteDaddy once signed a check on my parent's joint account, an account they had held for 20 years. The bank called thinking it was a forgery because they had never seen his signature on a check in all those years.

ReplyDeleteTab - President Clinton's soda of choice.

ReplyDelete